The Complete Guide to Arizona Car Insurance Coverage Requirements (2025)

Arizona law requires all drivers to carry a minimum car insurance coverage.

Understanding these requirements from the Arizona Department of Transportation is essential for staying legal on the road and protecting yourself financially in case of an accident.

Please note: We are accident doctors who charge you $0 out of pocket for the best after car accident medical care.

You should come in and get treated by us first, and then let us refer you to the best auto accident attorneys in Phoenix or Mesa.

Key Takeaways

Minimum Coverage Requirements

- Bodily injury liability: $25,000 per person, $50,000 per accident.

- Property damage liability: $15,000 per accident.

- Known as “25/50/15” coverage.

- Minimum requirements often insufficient for serious accidents.

Recommended Additional Coverage

Optional Protection:

- Uninsured motorist coverage.

- Underinsured motorist coverage.

- Medical payments coverage.

- Collision coverage.

- Comprehensive insurance.

Penalties for Non-Compliance

- First offense: $500 minimum fine, 3-month license suspension.

- Second offense: $750 minimum fine, 6-month suspension.

- Third offense: $1,000 minimum fine, 1-year suspension.

- SR-22 requirement for two years after violations.

State-Specific Rules

- Arizona is an “at-fault” state.

- Digital or physical proof of insurance required.

- All drivers must maintain continuous coverage.

- Seat belt laws apply to drivers and passengers under 16.

- Hands-free device required for cell phone use.

Financial Considerations

- Average annual full coverage premium: $1,845.

- Average minimum coverage premium: $861.

- Premium range: $770-$3,529.

- 12% of Arizona drivers are uninsured.

- Higher coverage limits recommended for better protection.

Arizona Requires These Minimum Car Insurance Requirements

To legally drive in Arizona, you must carry at least:

Bodily Injury Liability Coverage:

$25,000 per person

$50,000 per accident

Property Damage Liability Coverage:

- $15,000 per accident

Importance of Higher Coverage Limits

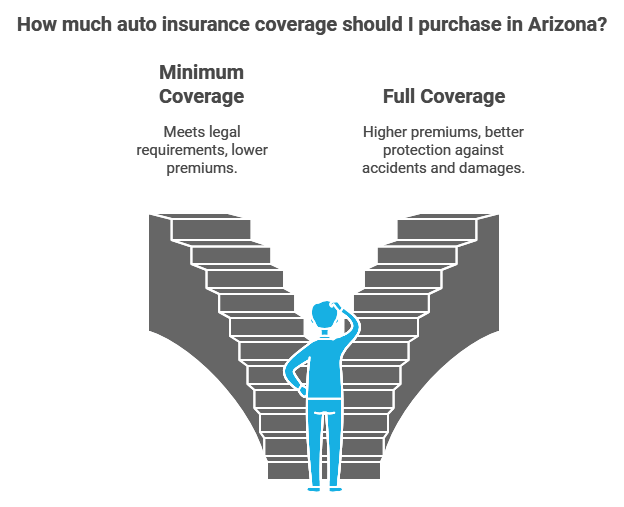

These minimum requirements are often referred to as “25/50/15” coverage.

While this is the bare minimum, it’s usually insufficient to protect you in a serious accident fully.

Additional Recommended Coverage

Beyond the minimum amount of insurance, consider adding these optional coverage to your car insurance policy when you get your insurance quote from your insurance agent:

Uninsured Motorist (UM) Coverage: Protects you if a driver hits you without insurance or in a hit-and-run. Real-life scenario: If an uninsured driver causes an accident that leaves you with $50,000 in medical bills, UM coverage will help pay those expenses.

Underinsured Motorist (UIM) Coverage: Kicks in if the at-fault driver’s liability coverage isn’t enough to cover your medical costs.

Medical Payments Coverage: Pays for your medical expenses after an accident, regardless of who was at fault.

Collision Coverage: This covers damage to your vehicle from collisions with other cars or objects. Learn more about what to do after a car accident.

- Comprehensive insurance protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters. It can provide peace of mind, especially if you live in an area prone to extreme weather events.

While Arizona’s minimum insurance requirements seem sufficient, they often fall short of covering the full costs of a serious accident. Higher coverage limits provide better protection for your assets and help you avoid paying out of pocket for expensive medical bills or property damage.

Arizona Car Insurance Statistics (2021-2022)

| Category | Value |

|---|---|

| Average Annual Full Coverage Premium | $1,845 |

| Average Annual Minimum Coverage Premium | $861 |

| Overall Premium Range | $770-$3,529 |

| Percentage of Uninsured Drivers | 12% |

| Traffic Fatalities per 100 Million Vehicle Miles Traveled | 1.71 |

| Auto Thefts per 100,000 Inhabitants | 295 |

Penalties for Driving Without Insurance

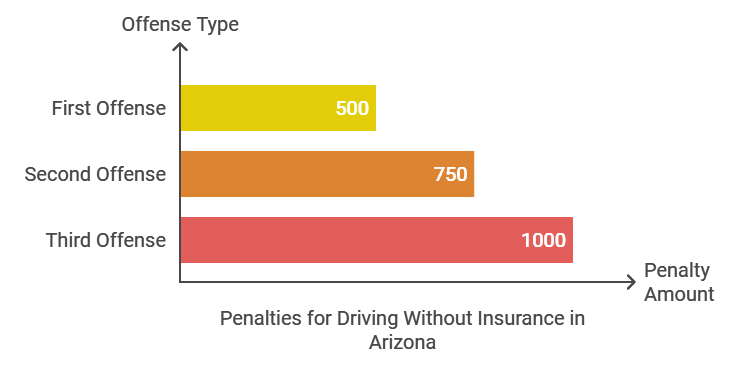

Getting caught driving without car insurance in Arizona comes with severe penalties:

| Offense | Penalties |

|---|---|

| First | – License plate confiscation – $500 minimum fee – 3-month license/registration suspension – 2 years SR-22 requirement |

| Second | – License plate confiscation – $750 minimum fee – 6-month license/registration suspension – 2 years SR-22 requirement |

| Third | – License plate confiscation – $1,000 minimum fee – 1-year license/registration suspension – 2 years SR-22 requirement |

An SR-22 is a form your insurance company files with the state to verify you have the minimum required liability insurance. You’ll need to maintain an SR-22 for two years after a lapse in coverage.

Arizona Driving Laws and Regulations

At-Fault State: Arizona is an “at-fault” state, meaning the driver who caused the accident is responsible for covering damages.

Seat Belt Laws: All drivers and passengers under 16 must wear seat belts.

- Distracted Driving Laws: It’s illegal to talk or text on a cell phone while driving unless using a hands-free device.

Practical Tips for Arizona Drivers

Proof of Insurance: Always carry proof of insurance, either a physical card or a digital version. You’ll face serious penalties if caught driving without it.

SR-22 Requirements: If your license is suspended or revoked, you may need to file an SR-22 to prove you have insurance coverage.

- Vehicle Inspection Requirements: You must provide proof of ownership and insurance when purchasing or registering a vehicle. Inspections may be required to verify the vehicle’s condition and safety.

Financial Consequences of Uninsured Driving

Driving without insurance in Arizona can result in severe fines, license suspension, and even jail time.

However, the financial consequences of causing an accident without coverage can be even more devastating.

Real-life scenario: Let’s say you cause an accident that results in $100,000 in damages.

Without insurance, you’d be personally responsible for those costs, potentially leading to wage garnishment, property liens, or even bankruptcy.

Conclusion

Arizona auto insurance requirements are in place to protect drivers financially and ensure everyone on the road is covered.

By understanding the minimum requirements, considering additional coverages, and staying within the law, you can confidently drive knowing you’re properly insured.

FAQs

#1. What happens if I’m caught driving without insurance in Arizona?

First-time offenders face license plate confiscation, a $500 minimum fee, a 3-month license/registration suspension, and a 2-year SR-22 requirement. Penalties increase for subsequent offenses.

#2. Do I need uninsured/underinsured motorist coverage in Arizona?

While not legally required, UM/UIM coverage is highly recommended. It protects you if a driver without insurance hits you. Learn more about coping with emotional trauma after a car accident.

#3. How much car insurance do I have in Arizona?

While the state minimum is 25/50/15, most experts recommend at least 100/300/100 coverage for better protection. When choosing coverage limits, consider your individual needs and assets.

#4. What factors affect my car insurance rates in Arizona?

Your driving record, age, vehicle type, credit score, and location can all impact your premium. Shop around and compare quotes from multiple insurers to find the best rates.

#5. How can I lower my car insurance premiums in Arizona?

You can lower your rates by maintaining a clean driving record, choosing a higher deductible, bundling policies, and taking advantage of discounts for safe driving or low mileage. Discover the truth about whether car safety features lessen accidents.

#6. What should I do if I’m in a car accident in Arizona?

First, check for injuries and call 911 if necessary. Then, exchange information with the other driver, take photos of the damage and file a police report. Notify your insurance company as soon as possible. Consider finding the right auto accident doctor to assess any injuries.

#7. How long do I have to file an insurance claim after an accident in Arizona?

You generally have two years from the accident date to file a claim for personal injury or property damage. However, it’s best to notify your insurer and start the claims process as soon as possible.