A Complete Guide & Checklist for Car Accident Symptoms

Facing the aftermath of an auto accident can be overwhelming.

Did you know that timely reporting and accurate documentation significantly impact your insurance claim?

This article will guide you through creating a comprehensive symptom checklist for insurance claims, covering everything from physical injuries to vehicle damage.

Please note: We are accident doctors who charge you $0 out of pocket for the best after car accident medical care.

You should come in and get treated by us first, and then let us refer you to the best auto accident attorneys in Phoenix or Mesa.

Key Takeaways

Immediate Actions

Safety Priorities

- Move to safe location if possible.

- Turn on hazard lights.

- Check for immediate injuries.

- Call emergency services if needed.

- Exchange information without admitting fault.

Documentation Requirements

Essential Information

- Photos of accident scene and damage.

- Contact details of all parties involved.

- Insurance information.

- Police report numbers.

- Witness statements.

- Weather and road conditions.

Physical Symptoms

Key Warning Signs

- Visible injuries and bruising.

- Neck and back pain.

- Headaches.

- Dizziness.

- Numbness or tingling.

- Joint pain and stiffness.

Psychological Symptoms

Mental Health Indicators

- Anxiety and stress

- Sleep disturbances

- Flashbacks

- Depression

- Driving anxiety

- Emotional changes

Follow-up Steps

Critical Actions

- Seek immediate medical evaluation.

- Report to insurance company promptly.

- Keep detailed symptom records.

- Document all medical visits.

- Track all accident-related expenses.

Immediate Steps After a Car Accident

Right after a car crash, your safety comes first. Move to a safe spot, then swap contact and insurance details with the other person driving.

Ensure safety first

Check everyone for injuries after a car crash. If someone is hurt, call 911 right away. Safety comes before anything else, so move to a safe spot if you can.

Turn on your hazard lights to warn other drivers and prevent further accidents.

Exchange vital information but never admit fault at the scene.

Gather license plate numbers, driver’s licenses details, and insurance company info swiftly and accurately.

Keeping calm helps everyone involved handle the situation better and makes it easier for police officers when they arrive.

Safety isn’t just a slogan; it’s a way of life.

Exchange information with the other driver

After a car accident, talking with the other driver is key. You must swap names, contact details, and insurance information—this includes your insurance company’s name and policy number.

Don’t forget to exchange vehicle registration numbers as well.

If they have it on hand, get their automobile’s identification number too. This step sets the foundation for handling the aftermath with your insurance agent.

Make sure to also note the make, model, and color of the other car involved in the incident.

Gathering this info helps when you report the event to both your insurer and possibly even law enforcement if needed.

Details like where and when the crash happened are crucial pieces for your auto insurance claim or if legal actions follow.

Sharing accurate information swiftly leads to smoother interactions with body shops, rental car agencies under your collision damage waiver, or dealing with uninsured motorists—all aiming for a faster return to normalcy after an auto accident.

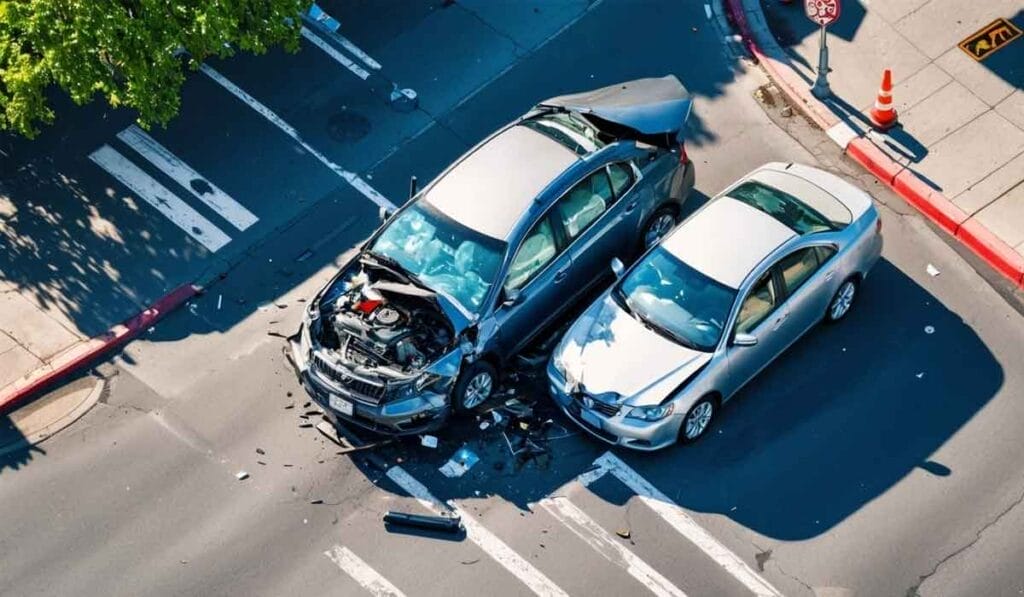

Document the accident scene

Take photos of the accident scene, capturing angles that show the position of automobiles involved.

Ensure these images include street signs or landmarks to establish location clearly.

Photos should also cover any damages to your vehicle and the other party’s, focusing on areas impacted during the collision.

This visual documentation is crucial for insurance claims and can provide undeniable evidence in case of disputes or legal action.

Gather details from witnesses, collecting names and contact information. These individuals can offer invaluable statements that support your account of events.

Keep a note of traffic patterns and weather conditions as they might influence both the occurrence and outcome of the auto mishap.

Documenting this accurately aids in creating a comprehensive report for automobile insurance companies, ensuring all factors are considered during claim processing.

Symptoms to Check Post-Accident

After a car accident, watch for signs of trouble in your health, particularly whiplash symptoms, and in your vehicle. You might spot physical wounds or feel unusual stress, while damage to your car needs a thorough look too.

Physical injuries

Check your body for any signs of harm right away. Look for cuts, bruises, or broken bones.

Even if you don’t feel pain immediately, these injuries might show up later.

It’s crucial to document every scratch and ache since this will be important when talking to your insurance company about a personal injury claim.

Seek medical attention as soon as you can.

Doctors can find injuries like whiplash or internal bleeding that aren’t always obvious right after an accident.

Make sure to keep all records and bills related to your treatment, as they’re vital for filing claims with your insurance provider.

This step is not just about healing; it’s also a key part of gathering evidence if you need to prove the extent of your injuries later on.

Psychological symptoms

Feeling anxious or scared after a car accident is common. These feelings can turn into serious psychological symptoms, such as stress and depression.

You might find it hard to drive again or feel worried every time you get in a car.

It’s important to pay attention to these signs and seek help if they start affecting your day-to-day life.

Dealing with the aftermath of a traffic accident involves more than handling physical injuries and auto repairs.

Emotional recovery plays a big part too. If nightmares or flashbacks make it difficult for you to sleep, don’t ignore them.

These could be signs of post-traumatic stress disorder (PTSD), which requires professional support.

Talking to someone about your experience, whether it’s a friend or a therapist, can make a big difference in how you feel mentally and emotionally after an accident.

Vehicle damage assessment

Check your car for damage after an accident. Look at the body, windows, and tires carefully.

This step helps you understand if your vehicle has minor scratches or major issues. You might need to take it to an auto repair shop if things look bad.

There, experts can give a detailed review. They check every part of your car to see what’s broken or needs fixing.

Take pictures of all the damages for your records and insurance company. Know the market value of your car before the crash—this matters if your car is a total loss.

Talk to professionals about using original equipment manufacturer parts for repairs if possible.

Keep track of all costs involved in fixing your vehicle, including those covered by personal injury protection or subrogation rights under your insurance policy.

Reporting the Accident to Insurance

Let your insurance company know about the accident as soon as you can. This is a key step.

They will guide you on what to do next and how to make sure your claim covers everything it needs to.

Start by calling their customer service number or logging into your account online.

Be ready to share details of the incident, like when and where it happened, and any proof you have, such as photos or police reports.

Keeping all this information organized will help make the process smoother for everyone involved.

Ready to learn more? Dive deeper into each step and get expert tips on handling car accidents efficiently.

How to report

Contact your insurance company as soon as you can after the accident. Have your policy number, the date and time of the collision, and a detailed account of what happened ready to share.

You’ll also need to provide information about the other vehicle involved if it’s available.

This might include the driver’s name, their insurance details, and any photos you took at the scene.

Gather all documents relating to the accident—this includes police reports, witness statements, and receipts for any repairs your car needs or medical expenses.

It’s important to gather as much documentation as possible to support your case.

Additionally, be aware of the Phoenix Arizona car accident statute of limitations, which is the time-frame within which you can file a lawsuit.

It’s important to act quickly and consult with a lawyer to ensure you don’t miss the statute of limitations deadline.

If you’re claiming under a rental agreement or need automotive repairs that could involve original equipment manufactured parts, make sure those documents are handy too.

The more detail you provide to your insurer—the smoother the process will be.

Accuracy in reporting saves time and prevents headaches later on in your claim process.

What information to provide

After a car crash, gather all the necessary facts to share with your insurance company.

This includes personal details like names, addresses, and phone numbers of everyone involved.

Also collect license plate numbers along with the make, model, and year of each vehicle. Note down insurance policy numbers from all parties.

Next step – describe how the accident happened. Start with where and when it took place, moving on to detailing road conditions that might have played a part.

Don’t forget to include witness statements if there are any; they could be crucial for your claim.

Photographs or videos of the scene can act as strong evidence, so hand those over too.

Your insurer will need this comprehensive info pack to process your claim efficiently—whether it involves physical injuries needing medical attention or damages requiring repairs from an aftermarket service provider.

Keep track of expenses incurred due to the accident such as medical bills or costs related to hiring a replacement vehicle while yours is in the junk yard waiting for fixes—all these details count towards establishing your needs post-accident.

Lastly, report any interaction you may have had with law enforcement at the scene; whether you spoke directly to officers from Arizona Department of Motor Vehicles or filed a report regarding auto theft suspicions linked possibly linked insurance fraud indicators—this documentation reinforces your account’s validity and aids in accelerating subrogation processes if applicable.

What Not to Do After an Accident

Right after a car accident, it’s crucial not to admit fault. This mistake could affect your claim with the insurance company. Keep reading to learn more smart moves post-accident.

Common mistakes to avoid

Avoid admitting fault at the scene. It’s crucial to let insurance companies and law enforcement determine who is responsible for the auto accident.

Saying “I’m sorry” can be seen as an admission of guilt, complicating your claim with the insurance company.

Another mistake is not reporting the incident to your insurance company in a timely manner.

Whether it’s a minor fender bender or a more severe collision, failing to report can violate your policy terms, risking coverage for damages.

Also, skipping on gathering witness information and photos from the accident site may weaken your position when filing a claim or dealing with subrogation matters.

The finest detail could be key in resolving disputes; never overlook documenting every aspect of the incident.

Not consulting healthcare professionals after experiencing symptoms post-accident risks undervalued settlements for personal injuries sustained during automobile accidents.

Remember, documentation from healthcare providers strengthens claims significantly.

Lastly, attempting to navigate complex legal and financial processes without professional guidance often leads individuals into unfavorable outcomes in lawsuits or insurance claims related to auto accidents.

Seeking expert advice ensures you’re well-represented, protecting your rights throughout negotiations with insurers or in court proceedings involving subrogation conflicts.

Conclusion

With this handy guide, you’re well on your way to handling car accident situations better. Remember, documenting everything and knowing what symptoms to watch for can make a huge difference.

Talking to your insurance firm clearly and providing all necessary details helps ensure things go smoothly.

Steer clear of the common blunders many people make after accidents.

Armed with knowledge and readiness, submitting your insurance claim becomes less daunting, paving the path toward a fair settlement.

Stay prepared, stay informed.

FAQs

1. What is a car accident symptom checklist for insurance claims?

A car accident symptom checklist for insurance claims is a guide that helps insureds keep track of necessary details after an incident, like a hit-and-run. The information gathered can be crucial when dealing with your insurance company or the DMV.

2. How does this checklist help me with my loan and finance matters post-accident?

The checklist ensures you have all needed documentation to protect your financial interests, including those tied to loans, bank transactions, or seller agreements related to the vehicle involved in the accident.

3. Can this guide assist me in understanding subrogation during my claim process?

Absolutely! This essential guide includes advice on handling complex processes like subrogation—when one party has the right to step into another’s shoes legally—to ensure you’re not left at a disadvantage when it comes to taxes or underwritten costs.

4. Why is it important for payees involved in an accident to use this checklist?

Payees should use this list as it provides practical benefits by ensuring they have all necessary information ready when making their claims—helping them achieve their goal of receiving fair compensation swiftly.